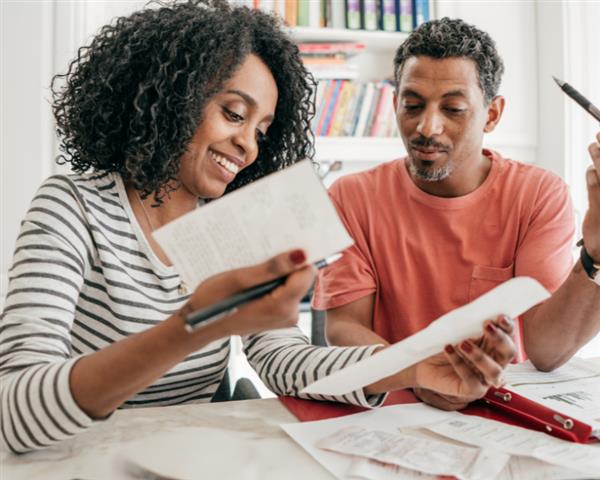

Finding good tenants in the current residential rental market - exacerbated by the Covid-19 pandemic, subsequent economic downturn and loss of household income - has become a major concern for many landlords and real estate agencies. According to Michelle Dickens, CEO of specialised credit bureau TPN, performance in the residential rental market is stunted as a result of rising supply due to tenant vacancy. From an investment perspective, landlords cannot earn passive income on a property that is vacant. If an investment property is vacant, the landlord has little choice but to fund the rental shortfall himself, which negatively impacts on his investment return.

“The tenant population of the residential market is arguably more sensitive to economic trends, which have an impact on employment and income”.

The Tenant Monitor Report for the fourth quarter of 2020, released in February of 2021, reported marginal increases in tenant performance (represented as the percentage of tenants in good-standing) towards the end of the year, despite the impact of successive, stringent lockdowns on businesses and households. The percentage of tenants in good-standing in the fourth quarter rose to 77.61%, from the second quarter low of 73.5%. Although this increase may appear to bode well for the ‘health’ of the residential property market, and tenant payment performance in particular, it is still significantly lower than the data recorded pre-lockdown. When viewed against the sharp rise in tenant vacancy that followed the hard lockdown the decline in tenant performance paints an entirely different picture.

Decline in Tenant Payment Performance

The percentage of tenants in good-standing (those who pay their rent to landlords on time and in full each month) has decreased considerably in comparison with pre-Covid data. According to Dickens, this marked decline was most likely due to increased financial constraints, with 75% of surveyed tenants reporting a permanent, temporary, or partial loss of income at some point during the course of the year. The deep recession that followed the second quarter lockdown of 2020 had a devastating effect on tenant employment and income loss, negatively impacting on rental affordability. As a result, tenant payment performance declined substantially across the country, whilst tenant vacancy spiked.

That said, the percentage of non-paying, partial-paying and late-paying tenants declined in the fourth quarter of last year, compared with the previous two quarters. These marginal increases in tenant payment performance seem to suggest that the relief measures implemented by landlords, financial institutions, and the Government – most notably the aggressive interest rate cuts – may have supported tenant payment performance by lowering household debt-servicing costs relative to income.

Which Segment of the Rental Market was Most Effected?

The weakest tenant performance was recorded in the lowest rental value segment (rentals less than R3 000 per month), which, according to TPN, represents the most “financially fragile” part of the tenant population. The high-end segment (R25 000+ per month) was just as hard-hit, influenced no doubt by the prolonged restraint on tourism and international travel, stunting the short-term rentals characteristic of corporate relocations. In conjunction to the weakest tenant payment performance, these two segments also have the highest tenant vacancy rate. Rentals between R7000 and R25 000 (especially those between R7 000 and R12 000) continue to outperform the other rental value segments and have remained relatively stable despite significant pressure.

The Connection between Increased Tenant Vacancy and Supply of Rental Property

As with any industry, performance in the residential property market is driven by supply and demand. Currently, rental supply continues to significantly outstrip demand. The TPN Vacancy Survey revealed that rental supply climbed sharply following the hard lockdown, relative to demand. Experts believe this sharp incline was a result of many destitute tenants who were forced to exit the market and shelter with family or friends while they recovered financially. However, affordability was not the only factor effecting the rise in rental vacancies. The increase may be attributed to other factors. For example, young professionals may have delayed entering the market due to lockdown-related financial constraints and chosen instead to remain at home with parents. Moreover, a large portion of the tenant population may have chosen to forego the rental market entirely in favour of home ownership, following severe interest rate cuts last year which improved first-time homebuyers’ eligibility.

A rising national average vacancy estimate explained TPN’s average rental value moving into deflation in the fourth quarter of last year. The steady decline depicted in TPN’s Rental Market Strength Index suggests further rental deflation can be expected in subsequent quarters. [The Rental Market Strength Index consolidates rental agents’ perceptions of rental supply and demand to give an indication of the current market strength, which remains below the ‘balanced’ level]

Nevertheless, StatsSA reported that economic activity in quarter one of 2021 has inched its way towards pre-Covid levels, since plummeting in the second quarter of 2020 when lockdown restrictions were at their most stringent. Real GDP (gross domestic product) rose to R761 billion in the first quarter of 2021, 2.7% below the R782 billion recorded a year earlier. An increase in real estate services (bond approvals and registrations) in the second half of last year drove economic activity in the finance, real estate and business services industry – which increased at an annulised rate of 7.4%.

In conclusion, a decline in tenant payment performance and rising supply due to tenant vacancy necessitate that the correct tenant vetting services are in place to secure well-screened, high quality tenants. Reputable estate agencies like Etchells & Young follow a comprehensive tenant-screening process that minimises the risk of vacancy or poor payment performance. Our Applications Department utilise TPN’s specialised screening systems to verify potential tenants’ credit history and affordability, as well as cross-check their rental payment history with previous landlords. Additionally, our professional estate agents are fully compliant and boast in-depth market knowledge and experience, a wide database of potential clients and access to popular online property portals for advertising. These services are crucial to finding and placing quality tenants in as short a time a possible, which is especially important in the current economic climate and complex rental market.

![What is POPIA? [Part 1]](https://s3.entegral.net/news/Thumbnail_2021_10_18_11_53_39_403.jpeg)