Thinking about buying your first home? First quarter statistics released by ooba Home Loans reveal first-time buyers’ continued confidence in the residential property sector. This is demonstrated in the high percentage of first-time buyers who have entered the market in the last year, despite the challenges brought on by the global pandemic and local economic downturn. Agencies across the country agree, reporting a surge in home buying activity despite the uncertainties.

The statistics reveal a significant increase of 15.1% in the average purchase price of first-time homebuyers when compared with the first quarter of 2020, and an increase of 3.5% compared with the last quarter of 2020. Percentage-wise, this kind of double-digit growth was last recorded only briefly in 2010 and again in 2015/16.

In January of this year the average purchase price paid by first-time buyers hit a new high of R1.138 million, after breaking the R1 million mark the year before. House prices, for both overall and first-time buyers, accelerated sharply in March of 2020 and have continued to rise steadily - further indication that the market has taken a positive turn. The rise in average purchase price suggests that the market is more accessible to aspiring homeowners who are now able to afford larger, more expensive properties. Demand for larger living spaces that can comfortably accommodate working from home may also be a contributing factor to the sharp rise in average purchase price. According to Rhys Dyer, CEO of ooba Home Loans, in conjunction to capitalising on the current buying environment buyers appear to be prioritising quality of life when purchasing a new home.

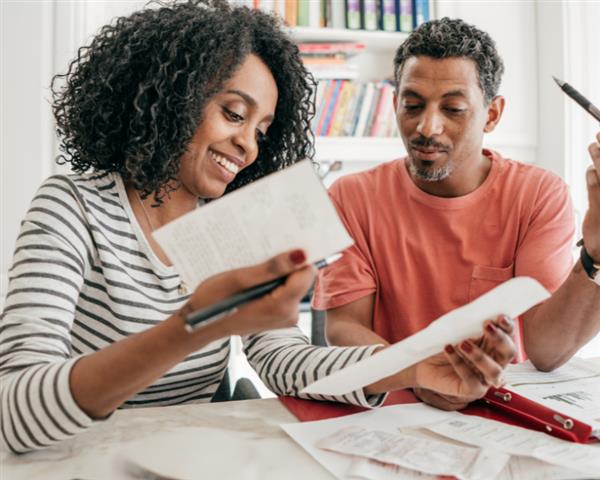

Financial institutions have continued to support and sustain the market and economy by offering low/no deposit loans. Moreover, competition between the banks to secure loan business has made it easier for first-time buyers to obtain finance. FNB reported that 2020 registered the highest volume of loan approvals in South Africa in more than a decade. In the last year, more than 50% of ooba’s approved home loans were extended to first-time buyers – the highest percentage recorded by ooba since data collection began in 2007. The volume of bond applications (with almost 70% belonging to first-time buyers) as well as bond approval rates are comparatively higher than previous years. This indicates that the interest rate cuts of 2020 and the banks’ lending appetite have bolstered applicants’ eligibility. Additionally, ooba statistics for Q1 of 2021 saw an increase of 14.8% in the average approved bond size for first-time buyers. Approval rates for hundred percent bond applications have also remained notably higher than previous years.

Its then no wonder that the statistics indicate that prospective buyers - who previously considered renting a more affordable and viable option than buying - are taking advantage of the lowest prime lending rate in five decades and favourable lending terms from South African financial institutions. Encouragingly, ooba’s statistics signify that home ownership is now a reality for many more South Africans.

If you’re thinking of buying your first home, now is as good a time as any to make the most of the current market conditions. View our Property for Sale.

![What is POPIA? [Part 1]](https://s3.entegral.net/news/Thumbnail_2021_10_18_11_53_39_403.jpeg)