Gone are days where you could buy a home in your 20's. Recent studies have shown that the home buyers in South Africa are no longer purchasing properties in their younger years, but rather at an older, more stable age.

According to recent research from home loan originator ooba, first-time home buyers increased by 12% in June, with the average age of buyers being 34.

In South Africa the average middle-class Millennial and younger Generation appear to be waiting longer to enter the property market." stated by Property Professional, the South African Industry magazine. John Loos, household and property sector strategist with FNB says since 1980 the property buyer population younger than 30 years has declined almost by half, from 22.15% to 12.34%.

That is quite a drop in the age market. Is it possible that younger people are just patiently waiting for the economy to improve so that they could purchase an affordable property? It seems as though a small percentage now covers the younger age gaps willing to buy a home but with many factors which add up to this. i.e.: Expenses, Interest Rates, the South African Rand,.

Millennials have become more independent and advanced with regard to technology and knowledge via social media which has made it easier to make decisions but with their age being a factor, credit score and lifestyle, the youth have somehow taken a step back which has caused a decrease in numbers for purchased homes.

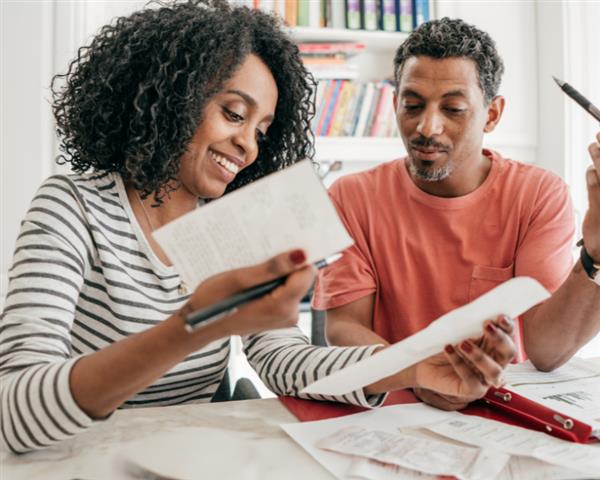

Saving money and investing has not been as easy as it has been before but with the right mind-set and goals, you can afford the property that you want with some time, thought and consistency. #AskEtchells It's time to rise up as a youth and take heed of the finer and more valuable things in life, such as adopting a healthier financial habit:

-

Set Financial Goals for yourself and work on achieving it, explore the economic world but do not put yourself in any debt. You don't want to get yourself black listed which will have a completely negative effect on your life moving forward.

-

Work on an affordable and realistic budget for yourself each month, and save or invest some extra money, even if you're just starting with R200. You will notice, in time of need, that R200 can go a long way.

-

Check your monthly bank statements, receipts on what you spend with regard to fuel, general expenses, and luxury and keep track of what you're spending. Realizing whether you want or need something makes a very big impact on your pocket, forget the "YOLO" line and remember to pave your future. Live and experience, but take your brain with you.

-

Save your overtime, extra cash, bonus money, promotion money and invest it or just save it and forget that you have the money until you may need it.

-

Work on building a more positive credit score which helps you in the future.

-

Change the way the youthful generation thinks, be the game changer.

![What is POPIA? [Part 1]](https://s3.entegral.net/news/Thumbnail_2021_10_18_11_53_39_403.jpeg)